A merger or acquisition transaction can be an effective catalyst for transforming the strategic positioning and market perception of a business. A transaction is a tangible commitment to a strategy and forces other industry participants and the investment community to reevaluate the combined business with a fresh perspective. The recent case study of DivX is a great example.

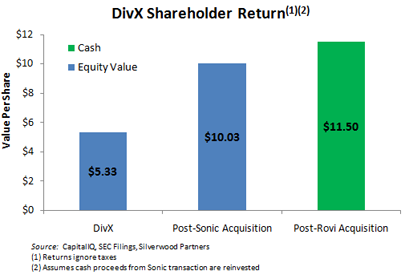

DivX completed its IPO on September 21, 2006, pricing at $16 a share, which was above the offering range of $12-$14. A little over two years later on New Year’s Day 2009, DivX was trading for $5.33, roughly a third of its IPO price.

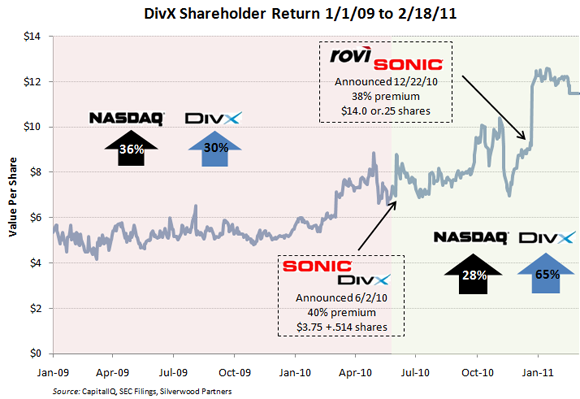

During the eighteen month period from January 1, 2009 until June 1, 2010 a DivX shareholder earned a 30% return, slightly less than the NASDAQ return of 36% over the same timeframe (omitting the dividends a holder of the NASDAQ stocks would have earned).

On June 2, 2010 DivX announced it was being acquired by Sonic Solutions at a roughly 40% premium to the trading level of its shares. A DivX shareholder received $3.75 cash and .514 shares of Sonic Solutions for each share owned. For the purposes of this exercise it is assumed the $3.75 cash proceeds were reinvested into Sonic Solutions stock.

Less than six months later Sonic Solutions announced it was being acquired by Rovi for a roughly 38% premium to its stock trading levels. The implication for a former DivX shareholder was the opportunity to elect to receive either $14 cash for the newly acquired Sonic Solutions’ shares or .25 shares of Rovi stock.

Ultimately a DivX shareholder that took the cash election would have received $11.50 cash on an equivalent basis for each former DivX share. Upon the closing of the transaction on February 17, 2011, a former DivX shareholder would have experienced a 65% return since June 1, 2010.

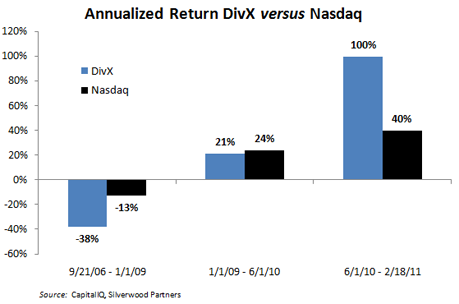

For comparison purposes it is useful to evaluate the annualized return a DivX shareholder would have received for the three time periods discussed:

For the two years following its IPO, DivX significantly underperformed the general technology market. For the 18 months beginning in January 1, 2009, DivX slightly underperformed the general technology market. A shareholder would then have experienced a remarkable escalation in value from the point of sale to Sonic Solutions – a 150% improvement over the broader technology market.